When it comes to workplace wellness incentives, few benefits make as immediate and tangible an impact as premium offsets. By covering a portion of employees’ health insurance premiums, employers can reward healthy behaviors in a way that directly reduces an employee’s monthly expenses. This approach not only boosts participation in wellness programs but also strengthens retention, satisfaction, and the perceived value of your benefits package.

Employer reimbursement for health insurance premiums is possible – with the right plan design and compliance in place. For those wondering “can an employer reimburse an employee for health insurance premiums?”, the answer is yes – with the right plan design and compliance in place. Structuring a premium offset within a wellness program allows you to directly tie financial rewards to participation in preventive care activities, wellness challenges, and other healthy behaviors.

Whether you’re exploring how to reimburse employees for health insurance premiums for the first time or looking to optimize an existing wellness program, understanding how premium offsets work and why they’re so effective will help you design an incentive strategy that delivers measurable results.

In this blog, we’ll break down how premium offsets fit into a broader wellness program, how to set them up compliantly, and the data that proves their value.

Table of Contents

- What Is a Premium Offset and How Employer Reimbursement for Health Insurance Premiums Works

- Why Premium Offsets Work: The Engagement & ROI Connection

- Designing a Premium Offset Program That Delivers

- Compliance and Administration Made Simple

- Real-World Applications: Examples from IncentFit Clients

- The Business Case for Premium Offsets

- Conclusion and Next Steps

- Premium Offsets: FAQs

What Is a Premium Offset and How Employer Reimbursement for Health Insurance Premiums Works

A health insurance premium offset is a type of wellness incentive where employees can reduce their health insurance premiums by meeting defined wellness goals, such as completing a biometric screening, participating in fitness challenges, or maintaining preventive care schedules. It’s one of the simplest ways to structure employer reimbursement for health insurance premiums while staying compliant.

Unlike gift cards or points, premium offsets directly lower an employee’s out-of-pocket costs for healthcare. This immediate, visible financial relief makes them one of the most valued wellness incentives.

Why They’re Gaining Attention:

The cost of health insurance continues to climb, with premiums for family coverage reaching $25,572 – up 7% from the previous year. At the same time, many companies struggle to get employees engaged in wellness programs, with average participation hovering at just 20–40%.

Premium offsets address both issues head-on. By offering a direct reduction in monthly premium payments, employers create a powerful, tangible motivator that employees can feel in their paychecks. IncentFit data shows that average participation rates in premium offset programs are 60-75%, representing a significant lift in engagement compared to other incentives. This higher participation translates into better health outcomes, stronger benefits satisfaction, and a more cost-effective wellness strategy for employers.

Why Premium Offsets Work: The Engagement & ROI Connection

Premium offsets succeed because they directly connect employer objectives (healthier employees, lower claims costs, stronger retention) with employee priorities (affordable healthcare and meaningful rewards). Unlike abstract perks, they address a very real financial pain point employees already think about every month: the cost of health insurance.

When the incentive is tied to something employees are already paying for and valuing, motivation happens naturally. It’s not just about dangling a carrot; it’s about removing a real, recurring expense in exchange for healthy actions. That link between personal benefit and organizational goals is why premium offsets consistently outperform other wellness incentives in both participation and impact.

Three Reasons They Outperform Other Incentives:

- High Perceived Value

- Behavior Reinforcement

- ROI Potential

High Perceived Value

Even modest reductions feel significant over time. For example, a $20/month premium reduction equals $240/year, and unlike a one-time $50 gift card, this benefit shows up month after month. That repeated impact reinforces the value of the program in an employee’s mind, making it more likely they’ll stay engaged year-round.

Behavior Reinforcement

Gift cards or spot bonuses often lead to “one-and-done” participation, where employees complete a single activity to claim the prize and then disengage. Premium offsets work differently – they can be tied to ongoing behaviors such as meeting quarterly preventive care goals, participating in monthly challenges, or maintaining biometric improvements. This structure rewards consistent action, leading to lasting habit formation and improved health outcomes.

ROI Potential

Premium offsets aren’t just about participation, they’re about measurable health and cost improvements. By linking the incentive to specific, high-impact actions such as managing chronic conditions, completing annual screenings, or engaging in targeted wellness programs, employers can reduce avoidable healthcare expenses over time. Healthier employees mean fewer claims, lower absenteeism, and a stronger return on wellness investments.

Designing a Premium Offset Program That Delivers

A well-designed premium offset program does more than just offer a discount – it drives sustained engagement, aligns with company health goals, and is financially sustainable for the employer. The most successful programs are intentional, transparent, and built for easy administration.

The most successful programs are intentional, well-structured, and follow the clear set of guidelines below:

- Define Measurable Goals

- Choose Your Structure

- Communicate Clearly & Often

- Automate Tracking & Payouts

- Review & Refine Annually

Step 1: Define Measurable Goals

Start by identifying exactly what you want to influence. Premium offsets work best when they’re tied to specific, trackable actions such as:

- Increasing preventive care participation rates

- Boosting physical activity through challenges

- Encouraging annual screenings or biometric checks

- Supporting chronic condition management

Be clear about which outcomes matter most to your organization. This will guide how you structure rewards and track success.

Step 2: Choose Your Structure

Your structure should align with both your budget and engagement goals. Common approaches include:

- Flat Amount – $25/month for meeting participation requirements.

- Tiered Rewards – $10/month for completing one activity, $20/month for two or more.

- Seasonal Incentives – Offer extra reductions during traditionally high-engagement months (e.g., January, September).

Step 3: Communicate Clearly & Often

Transparency is critical. Use plain language and concrete examples:

“Earn up to $300/year off your health premiums by completing a biometric screening and two wellness activities each quarter.”

Key communication tips:

- Announce the program well before the start date.

- Share reminders at key intervals (e.g., 30 days before goal deadlines).

- Utilize multiple channels, including email, intranet, manager toolkits, and benefits meetings.

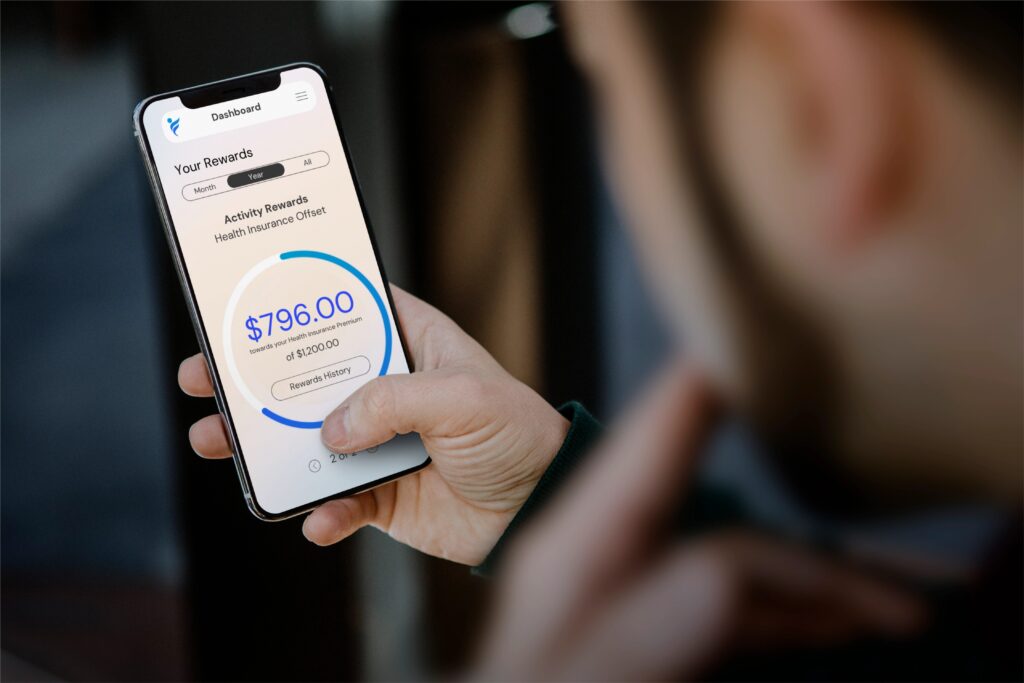

Step 4: Automate Tracking & Payouts

Manually tracking participation can be time-consuming and prone to errors. Platforms like IncentFit integrate wellness activity tracking with payroll and benefits systems, ensuring that:

- Employees see premium reductions automatically in their paychecks.

- HR teams aren’t buried in spreadsheets or verification requests.

- Compliance reporting is seamless.

Step 5: Review & Refine Annually

Use participation data, engagement trends, and health outcomes to make strategic adjustments:

- Increase the reward amount if participation is lagging.

- Rotate activities to keep employees engaged.

- Adjust timelines to fit your workforce’s seasonal patterns.

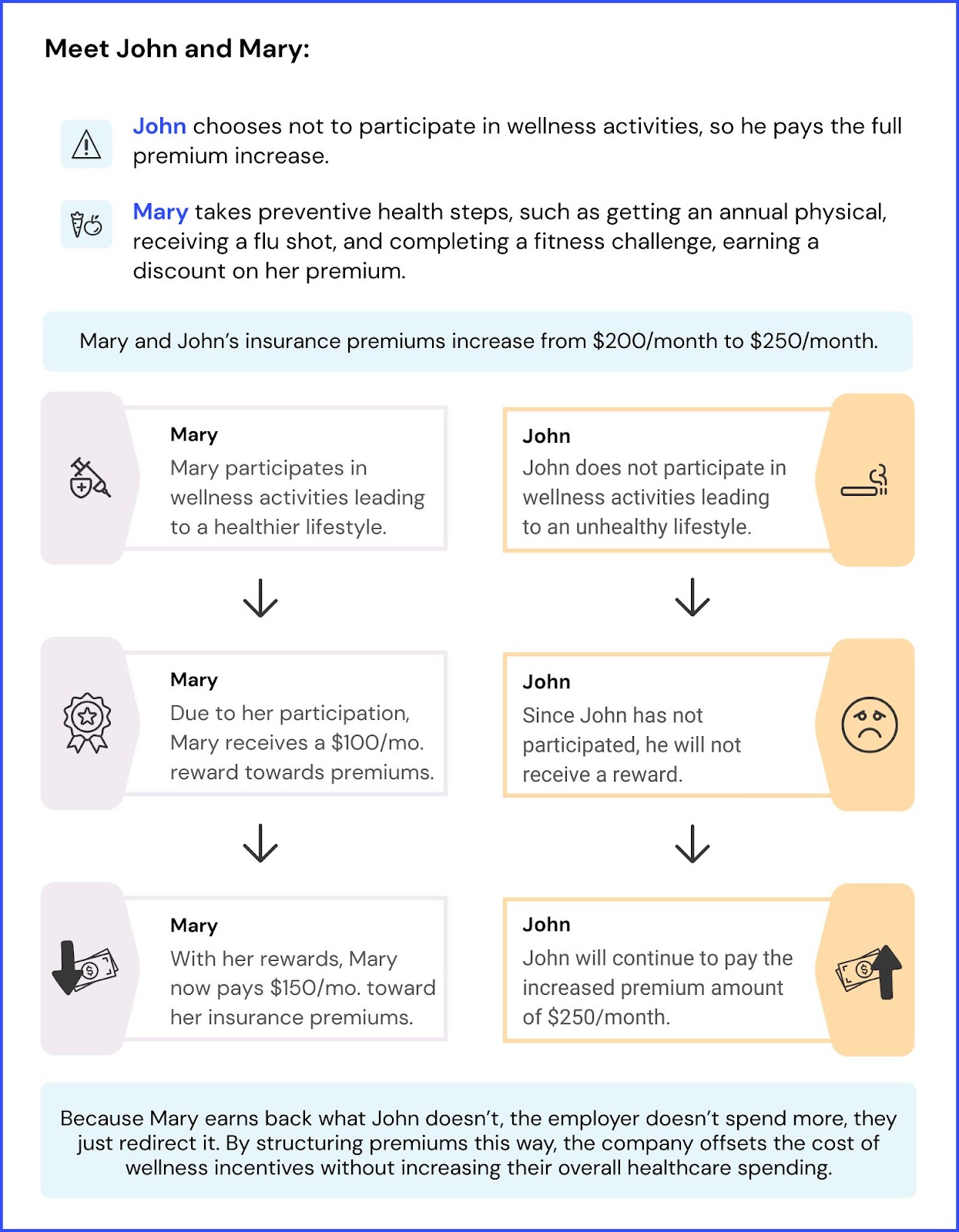

An Example of Funding Without Extra Employer Burden

Premium offsets don’t have to increase your benefits spend. Many employers set the “default” premium contribution slightly higher and then apply an offset for employees who meet program requirements.

If half your employees participate, contributions from non-participants can effectively fund the discounts for those who do. This structure rewards engagement without penalizing anyone – non-participants simply pay the standard rate, while participants enjoy reduced premiums.

Compliance & Administration Made Simple

A premium offset program isn’t just about creating incentives, it also has to follow legal guidelines and be easy to administer. Here’s how to ensure you stay compliant while keeping the process stress-free for HR teams.

Key Compliance Requirements:

- Voluntary Participation

- Reasonable Alternatives

- Incentive Value Caps

- Privacy and HIPPA Compliance

- Equal Employment Opportunity Commission (EEOC) Alignment

Voluntary Participation

Under the Affordable Cares Act, participation in wellness programs must be voluntary. Employees who choose not to participate must not face penalties beyond simply not receiving the incentive.

Reasonable Alternatives

If an employee cannot meet the requirements due to a medical condition, you must offer a reasonable alternative to earn the incentive.

Incentive Value Caps

The Affordable Cares Act caps wellness incentives tied to health outcomes at 30% of the total cost of coverage (or up to 50% for tobacco cessation programs). Make sure your offsets fall within these limits.

Privacy and HIPPA Compliance

Any health information collected for participation must be kept confidential and stored securely, with limited access for only those who need it.

Equal Employment Opportunity Commission (EEOC) Alignment

Ensure that program design does not discriminate against any protected class and that participation requirements are equally accessible across your workforce.

While compliance protects your organization legally, streamlined administration ensures the program actually runs smoothly. Premium offsets can be a powerful engagement tool, but without the right operational setup, they risk becoming a headache for HR and benefits teams. By building automation, integrating with existing systems, and keeping communication clear, you can deliver the incentive’s impact without adding administrative burden.

Administrative Tips for Smooth Operations:

- Integrate with Carriers and Payroll

- Automate Tracking and Eligibility

- Communicate Compliance in Plain Language

- Annual Review for Accuracy and Relevance

Integrate with Carriers and Payroll

Partner with your carrier to apply premium offsets directly to payroll deductions so employees see the savings automatically.

Automate Tracking and Eligibility

Use your wellness platform (like IncentFit) to track activities in real time and trigger offsets without manual HR intervention.

Communicate Compliance in Plain Language

Avoid benefits jargon. Tell employees exactly what they need to do, when to do it, and how they’ll see the savings.

Annual Review for Accuracy and Relevance

Check participation data, compliance rules, and carrier agreements to ensure the program stays competitive and aligned with legal requirements.

Real-World Applications: Examples from IncentFit Clients

Premium offsets are not just a theory, they’re working for organizations across industries and sizes. By tying meaningful financial incentives directly to wellness actions, these employers have seen measurable boosts in engagement, preventive care participation, and overall employee satisfaction.

Below are three examples of how IncentFit clients have structured their programs and the results they’ve achieved.

Example 1 – Professional Services Company (1,500+ Employees)

With IncentFit, this professional services firm gave employees the opportunity to earn up to $960/year toward their health insurance premiums. Employees could choose from dozens of activities – fitness facility visits, preventive care screenings, health assessments, even meditation – earning points toward their offset.

Result: 67% of employees participated, far exceeding the 20–40% industry average for wellness incentives.

Takeaway: A wide menu of options meant employees could engage in ways that fit their lifestyle, while IncentFit’s automated tracking and reporting kept administration simple.

Example 2 – Manufacturing Company (4,000+ Employees)

This manufacturer used IncentFit to offer up to $600/year in premium reductions for completing high-value preventive care activities like biometric screenings, annual physicals, dental and vision exams, and health assessments.

Result: Participation climbed steadily over three years, hitting 74% last year.

Takeaway: Tying the highest rewards to preventive care activities has steadily driven participation upward, peaking at nearly three-quarters of the workforce. The data suggests that clear, high-dollar incentives tied to specific actions can outperform generic wellness rewards.

Example 3 – Construction Company (250+ Employees)

In a physically demanding industry, this construction firm wanted to make wellness benefits tangible. Using IncentFit, they allowed employees to earn up to $520/year toward premiums by completing a physical and biometric screening, plus up to $240/year in additional paycheck rewards for activities like exercise, attending lunch-and-learns, or logging volunteer hours.

Result: 67% of employees participated, even with variable work schedules and job sites.

Takeaway: Pairing premium offsets with flexible reward options gave employees multiple ways to benefit, and IncentFit’s mobile-friendly tracking made participation easy from anywhere.

Note: These examples also highlight an important financial dynamic – non-participating employees often offset the cost of rewards for those who do participate. This means that premium offsets don’t have to be a net financial burden for employers, especially when participation rates hover around 50–70%.

The Business Case for Premium Offsets

Premium offsets aren’t just a “feel-good” perk; they’re a strategic investment that benefits both employers and employees in tangible, measurable ways. When designed thoughtfully, they deliver returns far beyond what traditional wellness incentives achieve.

Benefits for Employers:

1. Higher Engagement in Wellness Activities

When the reward is tied to something employees already value (lower healthcare costs) participation rates rise organically. Many IncentFit clients see participation rates in the 60–75% range, well above the 20–40% industry average for generic incentives.

2. Lower Healthcare Claims & Costs

Premium offsets incentivize early detection and preventive care, which can reduce high-cost claims from untreated or late-stage conditions. By shifting care from reactive to preventive, employers can mitigate both acute medical costs and long-term chronic disease expenses.

3. Stronger Retention and Recruitment

Benefits with clear financial value help employers stand out in competitive job markets. Employees who see their employer investing directly in their health, via tangible premium reductions, are more likely to stay.

Benefits for Employees:

1. Immediate, Visible Financial Relief

In the past year, the average annual premium for family coverage hit $25,572 and continues to rise, making even modest offsets meaningful. A $25/month reduction saves employees $300/year – money they notice every paycheck.

2. Flexibility for Different Needs

Whether an employee prefers fitness challenges, preventive screenings, nutrition courses, or mindfulness programs, premium offsets can be structured to allow multiple pathways to earn the reward.

3. Long-Term Habit Formation

Unlike one-time rewards, ongoing premium offsets encourage sustained participation over the entire year, making healthy behaviors a consistent part of daily life.

Conclusion

Premium offsets prove that employer reimbursement for health insurance premiums isn’t just possible, it’s powerful. By connecting real financial relief to healthy behaviors, employers drive higher engagement, stronger retention, and measurable ROI.

If you want to explore how premium offsets could transform your organization’s wellness program, we can help. Schedule a strategy session with our Benefits Experts, and we’ll walk you through exactly how IncentFit makes it simple to design, launch, and track a premium offset program that delivers both engagement and ROI.

Premium Offsets: FAQs

Q: Can an employer reimburse health insurance premiums through a wellness program?

A: Yes, employer reimbursement for health insurance premiums can be structured as a voluntary incentive under ACA and EEOC rules.

Q: How is a premium offset different from an HRA?

A: An offset reduces premiums upfront; HRAs reimburse expenses after they’re incurred.

Q: How much should a premium offset be worth?

A: Most employers offer between $50–$100/month, depending on goals, budget, and program design.

Q: Do premium offsets work for all employee demographics?

A: Yes, because financial savings appeal universally. Participation can be boosted further with multiple activity options and an inclusive challenge design.